We covered this information in depth in a free webinar on Thursday, August 22nd. Watch the recording for free here.

Many students now attend public universities to reduce the cost of higher education. Unfortunately, students often face a considerable premium if they want to attend a public university outside their state of residence. This can be problematic if excellent and affordable public university options are limited within their own state.

The good news is that there are ways around the high premiums of going out of state. Before we get into this, though, let’s review the basic qualifications for in-state tuition.

Basic In-State Tuition Requirements

In general, establishing residency for in-state tuition is not worth the hassle. States have created elaborate rules for in-state tuition qualification to safeguard taxpayer-subsidized public universities. These domicile rules vary by state, but here are a few general guidelines:

-

- Twelve months: Generally, students must live in the state for a minimum of 12 months before enrolling in order to gain residency status.

- Proof of residency: Students need to provide documents such as voter registration, car registration, and conversion of their driver’s license as proof that they lived in the state at least 12 months prior to enrolling in school.

- Relocation purpose: Most states won’t grant residency if the student’s purpose for moving is primarily educational. Students must usually demonstrate financial independence in the state for at least 12 months before enrolling in school. Even so, some schools still may not recognize the student as an independent resident.

- Dependency: If parents claim the student as a dependent on their taxes, the student is considered a resident of the state where the parents hold residency. If the parents move to a different state, the student’s residency may not change. If the parents are divorced and live in different states, the student may qualify for residency in both states, depending on where the financial support comes from

Again, these are basic guidelines. Explore each state’s specific laws and visit the individual college’s website to verify its residency requirements.

If you’re interested in gaining residency, there are a few experts who can help you do it legally and ethically (or verify that it’s not worth the hassle). Check out InStateMe.com to see if residency is viable for your student.

A notable exception to residency rules: If one or both parents are in the military, many schools will offer a tuition waiver that allows the student to attend at in-state rates.

But what if you are not a resident? What are some ways to offset the high costs of out-of-state higher education?

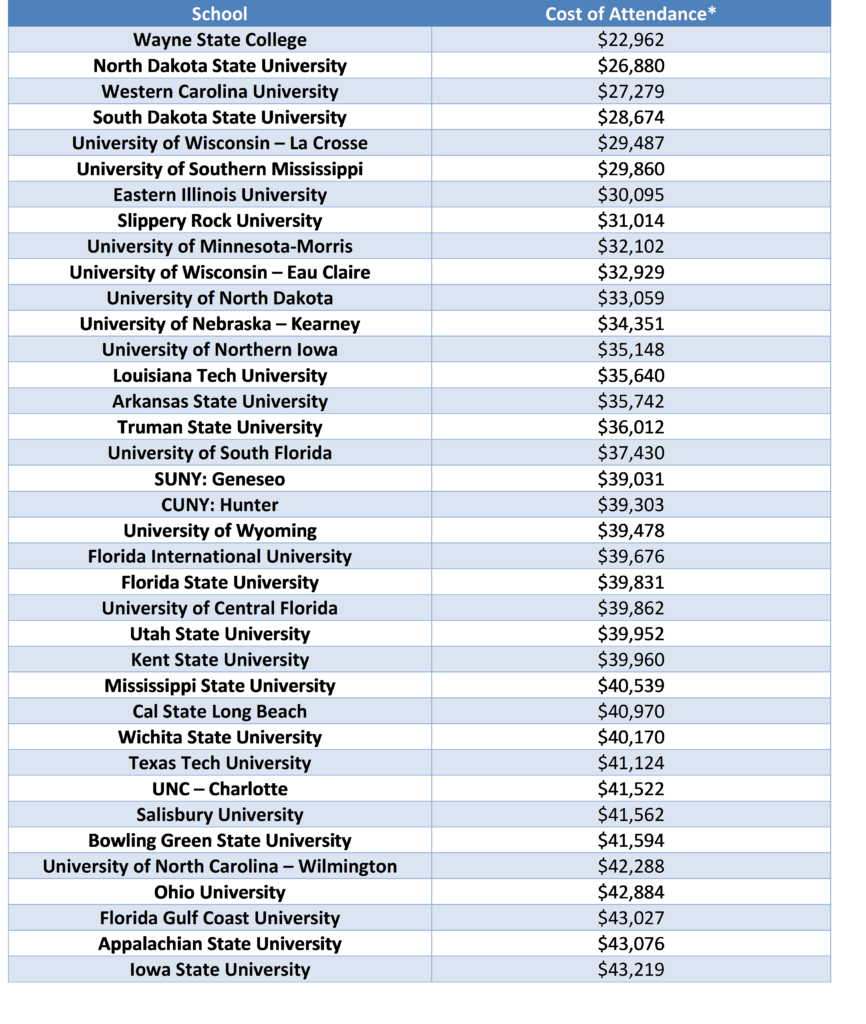

Strategy #1: Find Schools with Low Out-Of-State Sticker Prices

While many popular public universities still slap out-of-state students with a large tuition premium, many public colleges in less populated areas (especially in the middle of the country) are eager for students and willing to cut good deals.

At some of these colleges, the total annual cost of attendance is less than $30,000 per year for non-residents. Ok, yes, that’s still a lot of money. But consider this: schools like the University of Virginia and the University of Michigan charge close to $40,000 just for in-state residents and $80,000 for out-of-state students. This means it can be cheaper in some cases for students to attend public schools out of state without even considering any forms of financial aid.

Here’s a short and definitely not exhaustive list of well-known colleges with lower sticker prices for out-of-state residents.

All the schools listed have a graduation rate near or over 50%.

*Cost of Attendance is based on the estimated annual cost for non-resident, first-year students living on campus and taking the typical course load (base tuition). These numbers may seem high because they include indirect costs (estimated personal expenses, transportation costs, and books/supplies). Numbers updated on July 31, 2024, using the college websites.

Remember, these are “sticker prices.” They are generic estimates of what you will pay all in without considering financial aid.

If you are applying to public out-of-state schools, financial aid will generally come in the form of non-resident merit scholarships/tuition discounts awarded by the school itself.

You will find that many of the schools listed above also give generous non-resident merit aid (even to average students).

Strategy #2: Look for Schools That Offer In-State Rates to Good Students

Some big state schools are so eager to attract talented out-of-state students that they offer non-resident students merit scholarships and tuition waivers which may lower tuition to in-state rates. Oftentimes, school applicants are automatically awarded these merit scholarships based on their academic performance.

Examples: One of the best examples of these schools is the University of Alabama. An incoming freshman can qualify to be a UA Scholar if he or she has a 3.5 GPA in high school and scores 30-31 on the ACT or 1360-1410 on the SAT. The University of Alabama will reward these students with $24,000 annually to offset out-of-state costs.

Some schools offer additional propositions in addition to general merit scholarships. Texas A&M University will waive non-resident tuition if your child receives a competitive scholarship (college/departmental scholarship) of at least $4,000 from them.

In no particular order, here are several state universities known to give sizeable merit packages to good students:

– University of Miami (Ohio)

– University of South Carolina

– University of Kentucky

– University of Vermont

– University of Arizona

– University of Louisville

– Ole Miss

– University of Tennessee

– Utah State University

– University of Oklahoma

Important Tip: When searching for affordable out-of-state schools, you should know this: extremely competitive flagship state schools like UVA, UCLA, UNC, or the University of Michigan are only going to give merit aid to the best of the best students. They don’t need to throw money at the “above-average” students whose parents are already willing and able to pay for the prestige. These schools tend to save the merit scholarships for a select few and focus on helping students who demonstrate financial need.

Merit Aid for Students Who Are Not ‘Excellent’

Your child doesn’t have to be brilliant to receive merit aid from certain schools. Although this money may not bring down the cost to in-state rates, it will help make these schools much more affordable, and may even be cheaper than in-state schools.

A good rule of thumb is to look at regional schools and state universities that want to expand their “geographical footprint” and find more students with different backgrounds.

In just a few minutes, with the almighty power of Google, we found a few examples of regional schools known for large tuition discounting:

– College of Charleston

– Winthrop University

– Louisiana Tech

Additionally, many of the colleges we listed in the “low sticker price chart” above offer average students non-resident tuition discounts.

What about bigger state universities?

The University of New Mexico offers the Amigo Scholarship, valued at over $22,000 a year if an out-of-state student achieves an ACT score of 23 and a 3.5 GPA OR a 26 ACT and 3.0 GPA. If you live in certain states nearby, you can qualify for in-state tuition with only a 3.0 GPA and a 20 ACT/1030 SAT through a regional exchange agreement, which we will further discuss in strategy #4.

Oklahoma State University will give non-residents $10,500 per year if they score just a 24 on the ACT or 1160 on the SAT and have a 3.0 GPA.

At the University of Arkansas, the New Arkansan Award waives 70 percent of out-of-state tuition for first-year students from neighboring states (Texas, Louisiana, Mississippi, Tennessee, Missouri, Kansas, and Oklahoma) who obtain at least a 3.2 GPA in high school.

Some schools waive out-of-state fees altogether for students who meet minimal qualifications, such as the University of Louisiana at Lafayette, which awards out-of-state tuition waivers to students with ACT scores of 20 or SAT scores of at least 1030, and GPAs of at least 2.5. UL Lafayette also offers more automatic scholarships based on academics that one can stack on top of this tuition waiver!

The Bottom Line: Many public universities are now offering good deals for out-of-state students to attend their college, deals that often require little additional effort on the student’s part. Please visit the “out-of-state” or “non-resident” scholarship web pages of colleges your child is interested in—you will find more details there.

Strategy #3: Find Legacy Scholarships

While legacy preference in admissions has recently come under fire, legacy scholarships are still very much a thing.

Many schools offer specific scholarships for legacy students (albeit, they tend to be on the smaller side). At some of these schools, applicants automatically qualify if they demonstrate or maintain a certain GPA/test score and have a parent or grandparent who graduated from that school.

Parents and grandparents, check your school’s website to see if they offer waivers or scholarships for legacy students.

Here are a few of the bigger alumni scholarships we found:

- The University of Missouri offers the Black & Gold Scholarship which grants a full waiver of non-resident tuition if the incoming student meets GPA and test score requirements and has a biological, adoptive, or step-parent who graduated from the university.

- The University of Nebraska offers a very generous $14,000 Legacy Tuition Scholarship to students who meet certain benchmarks.

- Boise State has the Alumni Legacy Scholarship that covers the cost of in-state tuition and fees. The applicant must have a relative who graduated AND is a member of the alumni association. The incoming student’s GPA must be at least 3.5.

- UL Lafayette waives the out-of-state fee for all incoming legacy students.

Qualifications and requirements for these scholarships often change, so be sure to double-check each year. It’s especially important to do your research right now, as attitudes toward legacy strategies are shifting. Additionally, schools continue to change their test policies and adjust their scholarships/waivers accordingly.

Strategy #4: Utilize Regional Exchange Programs and State Reciprocity Agreements

Several regional agreements offer non-residents discounted tuition rates at out-of-state schools. There can be certain caveats, such as minimum GPA or test scores, and/or you must pursue an eligible degree.

Western Undergraduate Exchange (WUE)

The Western Undergraduate Exchange has 160+ member colleges and is available to students who reside in the following states and territories:

- Alaska

- American Samoa

- Arizona

- California

- Colorado

- Federated States of Micronesia

- Guam

- Hawaii

- Idaho

- Montana

- Nevada

- New Mexico

- North Dakota

- Oregon

- Republic of the Marshall Islands

- Republic of Palau

- South Dakota

- The Commonwealth of the Northern Mariana Islands

- Utah

- Washington

- Wyoming

The Western Undergraduate Exchange allows students residing in these states to attend a college or university in the member states and pay only up to 150 percent of the in-state tuition rate.

There are strings attached of course.

Requirements: Whether you qualify for the tuition discount varies by school and the degree/program you wish to pursue. Individual schools may also have GPA and test score minimums to qualify.

Midwest Student Exchange (MSEP)

Through the MSEP, public institutions agree to charge students no more than 150% of the in-state resident tuition rate for specific programs.

States participating:

- Indiana

- Kansas

- Minnesota

- Missouri

- Nebraska

- North Dakota

- Ohio

- Wisconsin

Requirements: Similar to the other exchange programs, not every college participates, and each college sets its own admission guidelines regarding academic performance and what specific degrees would merit the discount.

Interesting Note: If you have the distinct privilege of residing in North Dakota, you have access to not one, but TWO regional programs: WUE and MSEP.

New England Board of Higher Education Tuition Break Program

Previously known as the Regional Student Program (RSP), NEBHE’s “Tuition Break Program” allows eligible students to save an average of $8,600 a year.

States involved:

- Connecticut

- Maine

- Massachusetts

- New Hampshire

- Rhode Island

- Vermont

Requirements: Students must be in an approved program or area of study; many colleges only allow eligibility if the student’s degree is not offered in their home state.

Academic Common Market

The Academic Common Market offers in-state rates to students who want to pursue a degree that is not offered in their home state. It covers most of the South and Mid-Atlantic.

Participating states:

- Alabama

- Arkansas

- Delaware

- Florida

- Georgia

- Kentucky

- Louisiana

- Maryland

- Mississippi

- Oklahoma

- South Carolina

- Tennessee

- Texas

- Virginia

- West Virginia

Requirements: The degree you want to pursue must NOT be available in your home state. Remember, only select colleges in the states listed participate, and those that do may set their own GPA and test score requirements.

You may have wondered if you could pick one of the eligible degrees and then just switch majors later on. Nope, if you switch you will be charged full out-of-state tuition. It is crucial to understand that you are locked into a specific program of study if you decide to use this tuition discount.

Note: North Carolina does not participate in the Academic Common Market.

State Reciprocity Agreements + Other Programs

Several states have reciprocity agreements that go beyond the regional programs mentioned above and offer in-state rates. These agreements usually have less stringent qualifications. Here are some major ones:

- Missouri-Kansas

- Wisconsin-Minnesota

- New Mexico-Colorado

- Ohio-West Virginia, Ohio-Indiana, Ohio-Kentucky.

Some schools will waive out-of-state tuition or provide a partial waiver to students living in border counties or cities, even if no formal reciprocity agreement exists. Other schools have their own unique tuition waiver programs that stretch well beyond their borders.

For example, the University of Maine offers a Flagship Tuition Match, which “allows eligible out-of-state students from specified states to attend UMaine at the same cost as their home state’s flagship institution.”

Wichita State offers a unique tuition discount to students depending on what city they live in. Check it out below:

DC Tuition Assistance Grant Program

Since Washington D.C. residents are limited in their public university options, DCTAG awards a $10,000 grant to help cover the cost of out-of-state schools. You can read more about it here.

Florida Grandparent Residency Law

The state of Florida allows its public universities to award a limited number of tuition waivers to out-of-state students who have a grandparent legally residing in Florida. Prospective students must meet yearly academic requirements to qualify, most notably scoring in the 89th percentile or higher on the SAT or ACT.

Here’s an example of the tuition waiver found on Florida State University’s website.

Strategy #5: The Military Route

Obtain a ROTC Scholarship

Entering the Reserve Officers’ Training Corps is one way to drastically reduce the out-of-state premium—if you obtain a scholarship.

Contrary to popular belief, however, one does not automatically receive an ROTC scholarship. These scholarships are competitive (meaning there are only a certain number available and you must apply for them).

As a very general rule, starting from least to most competitive scholarships to obtain, it goes the Army, then the Navy, then the Air Force. The Marine Corps has a program as part of Naval ROTC. The Coast Guard offers its own scholarship program called The College Student Pre-Commisioning Initiative.

Accepting an ROTC scholarship is a big deal. In exchange for a ROTC scholarship, you will have mandatory ROTC training, extra classes, summer training sessions, and a requirement to serve in the military post-graduation (4 to 8 years, depending on the branch).

Scholarships range from partial tuition to full tuition, fees, books, and even monthly stipends.

Not sure if ROTC is for you? You can often participate in the program for two to four semesters (as long as you don’t have a scholarship) without making a commitment to future service.

Lastly, make sure your schools of interest actually participate in your chosen ROTC program.

For more information on ROTC and scholarships:

Attend a Federal Service Academy

Joining the service may be the last thing your student wants to do; it may also be something they have never thought about. Here are the five federal service academies:

- The U.S. Naval Academy

- The U.S. Military Academy at West Point

- The U.S. Air Force Academy

- The U.S. Coast Guard Academy

- The U.S. Merchant Marine Academy

The federal service academies provide excellent academics, life skills, and a guaranteed job without charging tuition, room, or board.

As in life, things are never so simple. In return, you will probably have to serve at least five years in the military. These schools are competitive, have more complicated application processes than your average college, and are certainly not for everyone. In fact, only The Coast Guard Academy does not require a congressional nomination to attend.

Bonus Strategy: Don’t Overlook Private Schools Due to High Sticker Prices

Find the Right Fit: Financial, Academic, and Social

Yes, this is a blog about reducing out-of-state costs. But, if you’re looking at out-of-state public schools, you should be investigating some private colleges as well, which, on average, tend to have more flexibility when it comes to “free money.”

Consider whether going to an out-of-state school actually makes sense given your financial situation and your student’s academic/extracurricular record. For example, families with a lower Student Aid Index may be better off focusing on in-state schools and private colleges that meet most or all of the family’s need.

Students with higher SAIs but strong academics may find that some private colleges offer them sizeable tuition discounts.

Don’t be put off by the exorbitant sticker prices of many private colleges; they can be more affordable than you think.

Ultimately, cast a wide net. What list of schools can you put together that are affordable, meet your student’s needs, and will maximize engagement for your student?

Final Thoughts

As discussed, these are the major ways to minimize out-of-state costs:

- Find colleges that already have low sticker prices for non-residents.

- Find colleges that want you and have a history of bringing out-of-state costs closer to resident tuition.

- Figure out if you qualify for legacy scholarships.

- Utilize regional exchange programs and state tuition reciprocity agreements.

- Consider the military path.

Ultimately, you and your child need to do your research. Maybe there’s a school you initially ruled out because you thought it was too expensive. Pore over the scholarships and financial aid pages for each college you’re interested in.

Investigate all options on each school’s website and/or call the school for a better explanation.

Leniency on cost will vary with each institution – even if there’s no state reciprocity program, some colleges will be more lenient if you live close to the border, have parent alumni, are a good student, or want to blaze your own path of study.

Never assume that you can’t negotiate a deal for yourself at any college. If you don’t try, you surely won’t succeed.

—

Next Steps:

1) Run your free College Money Report to determine your Student Aid Index and estimated cost of attendance at three different colleges.

2) Schedule your free consultation with one of our college funding experts.

By taking a comprehensive view of a family’s finances, we are often able to correct inefficiencies and capture dollars that can be redeployed toward paying for college. In addition to helping families bridge the gap between financial planning and financial aid, our approach helps parents reduce their out-of-pocket expenses and balance the challenge (and the stress) of saving for college and retirement simultaneously.

Author:

Related Reading:

The Top 15 Most Affordable State Colleges for High-Performing Students