This article was originally published on March 16, 2013. It was updated on June 20, 2019.

One of the biggest problems in planning to pay for college is that most parents simply don’t understand the rules of the game. And it’s not as if the colleges are doing a great job of teaching us the rules—they’re not!

It reminds me of the time I was told by a friend who is a Certified Public Accountant that a taxpayer could send all of his tax information to the Internal Revenue Service and they would diligently prepare a tax return. Yet, somehow the accounting profession still thrives—there is a reason why! The same is true for college funding—the colleges don’t want you to know the rules. We do.

For many families, the first time they start thinking about a strategy to pay for college, their oldest child is a high school junior or senior. Unfortunately, that may be too late. The key is understanding the rules and formulas, and taking action.

Endowments

College is big business. It’s no secret that many institutions of higher learning have significant war chests in their endowment funds. You can check out the full list, as reported by the National Association for College and University Business Officers (NACUBO) here. For example, at the end of 2018, Harvard University had over $38 billion in its endowment. The Cost of Attendance at Harvard is $73,800 (2018-2019). With $38 billion in its coffers—if we assume earnings of 5% on this money—Harvard could cover the cost of attendance for every one of its students (over 21,000) in perpetuity.

College is big business. It’s no secret that many institutions of higher learning have significant war chests in their endowment funds. You can check out the full list, as reported by the National Association for College and University Business Officers (NACUBO) here. For example, at the end of 2018, Harvard University had over $38 billion in its endowment. The Cost of Attendance at Harvard is $73,800 (2018-2019). With $38 billion in its coffers—if we assume earnings of 5% on this money—Harvard could cover the cost of attendance for every one of its students (over 21,000) in perpetuity.

Yet, Harvard still charges over $70,000 per student, per year. Why? Because they can. There are many families who can and will gladly pay $73,800 per year for a prestigious Harvard education. If your family can afford this expense, then Harvard will gladly take your money—via check, credit card or automatic bank draft—your choice. However, if you can’t afford this expense, Harvard had a $38,303,383,000 balance in their checkbook at the closing of the 2018 fiscal year. In other words, if you have the brains, but not the bucks, Harvard still wants you.

Unfortunately, many parents still look at the sticker price when considering their ability to pay. When buying a refrigerator, this makes sense. When paying for college, nothing could be more misguided.

Breaking Down College Cost

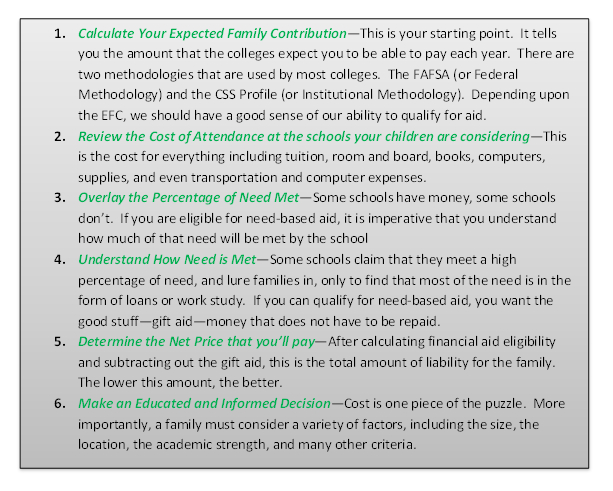

As an example, The College Funding Coach worked with a family from Ohio whose son was considering two very different Midwestern universities—Grinnell College in Iowa and The Ohio State University.

Grinnell is a very interesting college with lots of history…and lots of money. They have a little over 1,700 students and a $1.9 billion endowment. On the other hand, Ohio State is one of the largest universities in the country with more than 68,000 students across all campuses. Ohio State’s endowment had roughly $5.2 Billion at the end of 2018. I realize that a billion dollars is a large rounding error for you and me. But for colleges, it’s a different story. A college like Grinnell can stretch their budget further than Ohio State can.

stretch their budget further than Ohio State can.

When comparing schools, the first term with which to familiarize yourself is the Cost of Attendance. Every college publishes a Cost of Attendance figure. This includes tuition, room & board, books, fees, and personal and travel expenses. It is your cost all-in. Cost of Attendance at Grinnell is $70,346, while it’s only $27,340 for an in-state student at Ohio State.

The second term to know well is Expected Family Contribution. This is the amount that the colleges expect you to be able to pay on an annual basis. You can calculate your EFC here.

As you look at colleges and consider their financial aid packages, it is important that you understand gift aid versus self-help. Gift aid is other people’s money—grants and scholarships that do not have to be paid back. Self-help is loans and work-study programs—money that somehow, someway has to be paid back.

Finding the True Cost of College

So, for our aforementioned family, with an Expected Family Contribution of $15,000, the Net Price of the schools breaks down as follows:

This is a great example of how a family can take a school that, on paper, is more than double the Cost of Attendance of another school, and still pay less out-of-pocket. Because Ohio State is only able to meet 72% of aid, that’s our first red flag. Then, because they only meet 58% of this aid in the form of free money, that’s a second red flag. We’re not picking on Ohio State—it’s a great school with tons of tradition. For purposes of this discussion, it’s simply math.

This is a great example of how a family can take a school that, on paper, is more than double the Cost of Attendance of another school, and still pay less out-of-pocket. Because Ohio State is only able to meet 72% of aid, that’s our first red flag. Then, because they only meet 58% of this aid in the form of free money, that’s a second red flag. We’re not picking on Ohio State—it’s a great school with tons of tradition. For purposes of this discussion, it’s simply math.

When we work through this formula, the Ohio State option shows us that the family is eligible for $8,885 of need-based aid. $5,153 will be in the form of grants or scholarships, and the remaining 42%, or $3,732, will be in the form of a student loan or work-study.

To clarify, the “Out-of -Pocket Cost” is the Cost of Attendance minus the financial aid eligibility. For the True Cost (often called the Net Price), we add back in the self-help, because this is essentially your money. It’s paid to the university in the form of the student working at the library or in the chemistry lab, or in the form of student loans that have to be paid back with interest.

-Pocket Cost” is the Cost of Attendance minus the financial aid eligibility. For the True Cost (often called the Net Price), we add back in the self-help, because this is essentially your money. It’s paid to the university in the form of the student working at the library or in the chemistry lab, or in the form of student loans that have to be paid back with interest.

In the final analysis, the true cost to the family is $21,088 at Grinnell and $22,187 at Ohio State. Because Grinnell is a better fit for this particular student, we love that we were able to show this family how to make it all work. They did not pay anywhere near the sticker price when their son enrolled at Grinnell. We think that’s pretty cool!

Grinnell is one example of a school that has money, gives money, and gives it in the form of gift aid. There are myriad examples of schools that may have a high sticker price, yet they meet aid very generously.

Six Steps to Determine Your College Cost

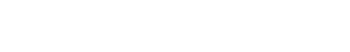

When we work with families, we encourage them to take the following steps to apply this formula to their particular situation:

A Parting Financial Aid Analogy

The best analogy for how financial aid works may be that of an airline: if a traveler went to Dulles International Airport to board a flight leaving in an hour bound for Los Angeles International Airport, and the flight was not full, the airline should take whatever they can get for that seat—the flight is leaving whether he is on board or not.

The same is true for colleges—the fall semester is “taking off” no matter what, so they have to offer enough financial aid to lure the family to make a commitment, and not a dime more.

It’s a fine line, but we believe that it is a critical area worth understanding. Some colleges are very good at giving money, and others are not so good. Take your time, do your homework, and make an educated and informed decision. Your financial future may be riding on it!

Sources:

https://www.nacubo.org/Research/2019/Public-NTSE-Tables

Authored by:

Oops! We could not locate your form.